In light of the increasing issues related to the environment, society, and corporate governance, investors have recognized the significance of incorporating ESG evaluation in the business valuation process. Historically, business valuation was frequently determined solely by conventional financial indicators such as profit, revenue, and return on investment. However, with the advent of ESG, prudent investors have realized that for a comprehensive understanding of a company's value, requires consideration of non-financial factors related to the environment, society, and corporate governance. Evaluating ESG enables investors to obtain a clearer perspective on business efficacy, sustainable production processes, company-community relationships, and the capacity to address social and environmental risks. Although the term ESG is becoming increasingly common and numerous academic and asset management industry researchers have analyzed the relationship between the ESG profile of companies and their financial risk and performance characteristics, assessing the impact of ESG on business valuation is still in its initial stages. In the report "ESG and Business Valuation" published by the International Valuation Standards Council (IVSC) in March 2021, the IVSC outlined its perspective on exploring the integration of ESG characteristics into the business valuation process as follows:

The market approach: the value of a business is determined by comparing the value of the subject business to comparable businesses based on factors such as scale, primary industry, business risks, financial risks, and financial indicators. When integrating ESG factors into the valuation process, valuers must:

Identify and assess ESG practices for comparable companies and industries.

-

Assess the performance of the subject company for such criteria, and

-

Adjust the subject entity's market inputs to account for its pertinent performance in comparison to the comparable companies.

Due to data and information constraints, ESG factors in market-based business valuation face similar challenges as traditional valuation. Due to the fact that the majority of market transactions are private, it is difficult and possibly inaccurate to locate analogous data. ESG is also novel, particularly in developing countries such as Vietnam. Environmental, social, and sustainability reporting standards are ill-understood, and only the largest corporations implement ESG programs. The majority of these businesses are unable to provide ESG-related investor information. ESG requirements vary by country and by rating agency. Numerous organizations, particularly private ones, use marketing to persuade consumers and investors that their products and services have positive market and customer impacts, which can modify valuation outcomes.

The income approach: The future net cash flow that can be projected at the valuation date is used to calculate business value. When utilizing this approach to determine the business value, an important note is that the valuer should not duplicate certain ESG factors which have already been implicitly incorporated into the valuation as a "new ESG risk". The distinction between systemic risk (market risk for all firms) and unsystematic risk (business-specific hazards) is frequently emphasized by experts. In the numerator of the Discounted Cash Flow (DCF) model, unsystematic risk is represented, whereas systemic risk is represented in the denominator.

In “Foundations of ESG Investing: How ESG Affects Equity Valuation, Risk, and Performance” published by MSCI Financial Services Company in July 2019, the authors conducted analysis and studies of data to draw conclusions regarding the specific impact of ESG on each factor, as follows:

Cash-flow: The cash-flow transmission channel can be summarized as follows:

Companies with high ESG ratings have a competitive advantage over their counterparts because they can better leverage resources, develop and manage their workforce effectively, foster innovation, and establish long-term business plans, along with implementing policies that encourage good governance. Fulfilling social duties also assists businesses in developing a true corporate image, which adds to gaining customers' hearts.

-

Companies with strong ESG ratings can capitalize on their competitive edge to generate higher revenue and profits. When they gain customer satisfaction and earn support from the wider society, businesses secure a strong position and their own voice in the market. With such credibility and reputation, companies can grow and increase profitability by optimizing their current advantages.

-

This translates into their capacity to increase stock value and dividends paid to shareholders.

Research suggests that ESG can reduce the discounting or minimization of tail risks for equities, in addition to the benefits of boosting competitive advantage. Companies with high ESG scores tend to have rigorous company-wide risk control processes and procedures. This lessens the possibility of catastrophic events like fraud, corruption, disputes, litigation, etc., that could have a negative impact on the company's value and stock price. This illustrates that adhering to ESG standards not only improves business performance and generates long-term value, but also helps reduce the likelihood and impact of unanticipated events, so enhancing the company's predictability and stability.

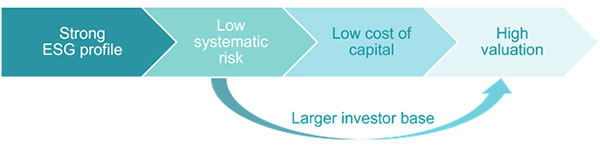

Valuation: As mentioned earlier, when valuing a business, systemic risks are reflected in the denominator of the DCF model. So, how does a business with strong ESG characteristics affect this denominator and the valuation process? The following model will provide a specific answer to this question:

Companies with strong ESG characteristics tend to be less vulnerable to systemic economic shocks such as fluctuations in commodity prices, interest rates, inflation, etc., compared to companies with low ESG ratings.

-

In the Capital Asset Pricing Model (CAPM), Beta is used to reflect the sensitivity of a stock-to-market risk (systemic risk). Therefore, lower systematic risk means a company’s equity has a lower value for beta, and therefore investors require a lower rate of return.

Experts agree that a large pool of investors has a direct effect on a company's valuation when systemic risk is minimal. Stocks of companies with low ESG ratings are often avoided by many risk-averse investors. Companies that score highly on ESG assessments typically place a premium on transparency in all aspects of their operations, including how they affect the environment, society, and governance. Investor confidence is bolstered, information risks are mitigated, and more channels for sharing a company's value and potential are opened up as a result.

Naturally, ESG's effect on a company's worth might range widely depending on the nature of the firm. Different ESG variables may have varying impacts on different types of enterprises. Family businesses that prioritize sustainability and brand-building can use ESG to their advantage by creating value and safeguarding the company for future generations. Trust and long-term value may be built for a family firm by its dedication to ESG concerns and its ability to maintain positive relationships with the local community and its workforce. However, due to their bigger scale, non-family firms may experience unique difficulties in implementing ESG. However, social and financial pressures on such businesses to improve their ESG ratings may be greater. More involved environmental and social initiatives, such as improving air quality or instituting fair labor rules, may be necessary for non-family businesses to meet ESG criteria. Community-based businesses can gain an edge in the marketplace, attract investors, and increase customer trust through the effective implementation of ESG standards. How environmental, social, and governance factors (ESG) affect a company's worth varies by sector. The rising emphasis on environmental protection and sustainable development, for instance, may result in a high valuation of the renewable energy and green technology industries when ESG standards are used. The significance of ESG, however, is conditional not only on the type of business but also on the manner in which ESG is implemented and maintained.

Similar to the "chicken and egg" dilemma, there is a causal link between high ESG ratings and high valuation. Companies that score higher on ESG metrics tend to be more valuable. This can happen if the cost of capital and systemic risk drop. Companies that do well on the ESG scale typically have strong risk management processes, transparent leadership, and a commitment to long-term viability. The value increases as a result of lower risk and lower capital expenses thanks to these elements. A high valuation, on the other hand, can encourage businesses to finance ESG-enhancing sustainable development projects. Companies having a lot of cash on hand can afford to improve their management of environmental factors as well as social and governance ones. Higher ESG ratings may result from this as ESG components are enhanced.

In summary, the current market environment places a premium on business valuation, with investors placing heavy emphasis on the sustainable development characteristics of organizations. In the absence of a consistent reporting system, organizations may choose to disclose only the minimum amount of information necessary to maintain their competitive edge. Limiting access to data for comparison and verification can make it difficult for investors to evaluate the efficiency of operations and cause vital details to be missed. Therefore, investors should take into account the company's environmental, social, governance, and sustainable development indicators alongside the company's overall economic and financial elements when evaluating and valuing the business.

DCF Vietnam - Regulated by RICS

This document's contents have been synthesized and analyzed from sources considered reliable; however, they are provided for general informational purposes only and are not intended to be a comprehensive analysis. Additionally, this document should not be considered as an advice. The structures, figures, and illustrations derived from this document may not be suitable for specific situations or requirements, and DCF Vietnam urges clients to seek specialized investment advice tailored to their specific situations or requirements. DCF Vietnam makes no representations as to the accuracy, dependability, or completeness of the information provided.

----------

Please contact us for more information:

DCF Viet Nam Corporation

🏢 46F, Bitexco Financial Tower, 2 Hai Trieu, Ben Nghe Ward,

District 1, HCMC

💌 info@dcfvietnam.com

☎️ 0763 304 430

🌐 www.dcfvietnam.com