Despite experiencing a turbulent period with significant impacts due to the COVID-19 pandemic, the real estate market has recently entered a state of "freeze," with many purchase and transaction trades slowing down and real estate prices tending to decrease, particularly in the suburban districts that had experienced rapid growth in the recent past, which dropped by 30% compared to before.

The psychological dread and apprehension of investors have contributed to the decline of the economy and the real estate market. However, each individual or organization must exercise caution and avoid appearing overly panicked or pessimistic. We must evaluate the issues objectively and discover appropriate solutions to overcome them. Anxiety and panic only worsen the situation.

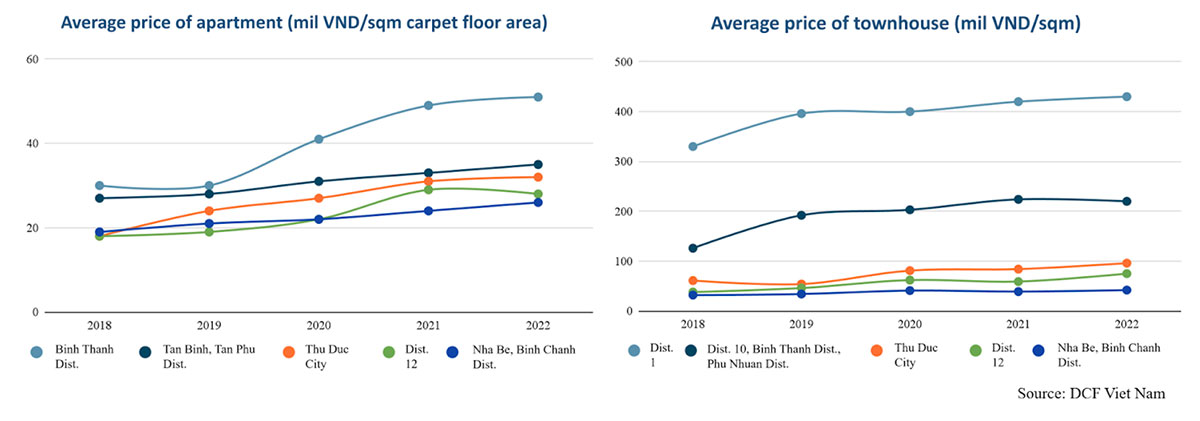

When reviewing the market over the past few years, astute individuals and investors will observe the growth rate of real estate prices and rental prices. According to market reports from batdongsan.com and price data from DCF Viet Nam, the average selling price of apartments in Ho Chi Minh City (HCMC) in 2022 increased between 30% and 90% compared to 2018, depending on apartment class and location. During 2018–2022, the average land price growth rate for frontage townhouses ranged between 30% and 100%.

As of the end of 2022, the average monthly rent for an apartment was approximately 13 million VND, which was equivalent to the pre-COVID-19 rental price. The rental yield, however, is comparatively low. In HCMC, the apartment rental yield (calculated as monthly rent multiplied by 12 months and divided by the apartment's selling price) was 5.9% in 2019, 4.9% in 2020, 4.1% in 2021, and 4.2% in 2022. In 2019, the average monthly rent for frontage residences was 45 million VND in the first quarter, 50 million VND in the second quarter, and 70 million VND in the third and fourth quarters. In 2020, the monthly rent decreased to 60 million VND in the second quarter, 55 million VND in the third quarter, and 50 million VND in the fourth quarter. This price remained stable for the first two quarters of 2021 before plummeting to 35 million VND per month in the third quarter. Then, rental prices increased substantially after the COVID-19 pandemic, and housing demand increased as workers returned to the workforce. However, the ability to maintain stability is high. In comparison to real estate prices, the rental price growth rate is very low, or even stagnant, according to these numbers. Individuals and investors who are interested in the current economic climate have access to advantageous rental prices.

To gain a comprehensive understanding of the real estate rental market, it is necessary to examine the factors and causes behind the creation of various rental price segments between suburban and central areas, as well as other factors that have contributed to the market's uniqueness and interest. As the country's primary economic hub, Ho Chi Minh City offers everyone opportunities for settlement and employment. Consequently, the number of immigrants in HCMC continues to rise annually. Luxurious apartment complexes, rooming houses, and rental apartments proliferate in all districts to satisfy the demand for housing. Therefore, each rental area in HCMC varies in terms of price, rental quality, and suitability for various tenant demographics.

In terms of geography, former District 2 (now part of Thu Duc City), Binh Thanh District, Tan Binh District, and Phu Nhuan District are situated in advantageous locations, and it takes between 10 and 30 minutes to reach the city center. On the other hand, these areas also feature commercial centers, retail centers, colleges, and other facilities and services. This location is ideal for locating an appropriate rental home, as the rental prices are significantly lower than in the city center and are suitable for individuals with stable incomes. However, rents are still quite expensive for students.

The districts located 7 to 20 kilometers from the city center include former District 9, former Thu Duc District (now part of Thu Duc City), former District 7, and former Go Vap District. Although far from the city center, these are still thriving apartment and rental house leasing markets. Former District 9 and Thu Duc District are considered a renter's sanctuary due to the high prevalence of students in these locations. Because developers are seeking large parcels of land to construct rental properties, the rents are more affordable and the living space is larger than in other areas with comparable rents. In addition, the cost of living is relatively low in suburban areas. District 7, due to its proximity to District 4 and District 1, frequently attracts office employees. Moreover, these regions have ample living space, fresh air, and shelter, as well as a popular villa rental type, particularly garden villas with a miniature golf course and upscale amenities. This form of rental is appropriate for a group of high-income expatriates residing and working in Vietnam.

The city's central districts, such as District 1, District 3, District 5, and District 10, are ideally situated for employment, study, and access to entertainment services. The Time Square apartment building, Central Garden, Vinhomes Ba Son (District 1), and Saigon Pavillon (District 3) are examples of high-end apartment segments available for rent in the heart of HCMC, with apartment rentals costing at least 20 million VND per month. Typically, the tenants here are expatriates working in Vietnam or wealthy families. In addition, rental houses are quite diverse, ranging from 1-2 floors to 3-4 floors with or without mezzanines, with rental prices that vary based on the house's location and condition. For instance, if the home is located on a significant road and can be used for commercial purposes, the monthly rent could range between 13 and 400 million VND. If a similar property is located in an alley, the monthly rent can range from 7 to 40 million VND. The final segment is rooming houses, which are preferred by individuals with average incomes, public employees, and students because the rent is within their financial means. Depending on the location and style of accommodation, the rent for a room in the central area ranges from 3 to 7 million VND.

The decision to purchase or rent a particular form of real estate depends on a variety of factors and personal objectives. Currently, renting a home to experience the neighborhood, amenities, and sort of property before deciding whether to continue renting or purchasing is an option. With this method, investors with inactive funds can invest in other investments to earn additional monthly income, using a portion of that income to pay for rental costs until the time is appropriate (based on their utilization requirements, asset type, and accrued funds) to convert to buying. In the current economic and real estate market environment, the Rent-Experience-Accumulate-Buy method is worthy of consideration.

DCF Vietnam - Regulated by RICS.

This document's contents have been synthesized and analyzed from sources considered reliable; however, they are provided for general informational purposes only and are not intended to be a comprehensive analysis. Additionally, this document should not be considered as an advice. The structures, figures, and illustrations derived from this document may not be suitable for specific situations or requirements, and DCF Vietnam urges clients to seek specialized investment advice tailored to their specific situations or requirements. DCF Vietnam makes no representations as to the accuracy, dependability, or completeness of the information provided.

Please contact us for more

information:

DCF Viet Nam Corporation – Regulated

by RICS

🏢 Headquarter: 46F, Bitexco Financial

Tower, 2 Hai Trieu, Ben Nghe Ward, District 1, HCMC

💌 Email: info@dcfvietnam.com

☎️ Hotline:

0763 304 430

🌐 Website: www.dcfvietnam.com