Vietnam’s corporate bond market has gone through major incidents that caused heavy losses for investors, highlighting the risks of poor transparency. Learning from this, the Government has set new rules in the Securities Law: any bonds issued with collateral must be valued by an independent appraisal company. This is not only a legal requirement but also an important measure to rebuild trust and ensure the market grows in a stable way.

To make the market more transparent, Law No. 56/2024/QH15 (effective January 1, 2025) clearly states: individual investors can only buy private corporate bonds if the bonds have both a credit rating and collateral or a bank guarantee. This forces companies to prove their financial strength and transparency before accessing funds from retail investors.

Vietnam’s corporate bond market has gone through major incidents that caused heavy losses for investors, highlighting the risks of poor transparency. Learning from this, the Government has set new rules in the Securities Law: any bonds issued with collateral must be valued by an independent appraisal company. This is not only a legal requirement but also an important measure to rebuild trust and ensure the market grows in a stable way.

To make the market more transparent, Law No. 56/2024/QH15 (effective January 1, 2025) clearly states: individual investors can only buy private corporate bonds if the bonds have both a credit rating and collateral or a bank guarantee. This forces companies to prove their financial strength and transparency before accessing funds from retail investors.

Earlier, Decree No. 65/2022/ND-CP (effective September 16, 2022) had already introduced the concept of “secured bonds” and required collateral to be appraised. If Decree 65 was the first filter to stop companies from overstating asset values, then Law 56 takes it further by creating a tighter and more consistent monitoring system.

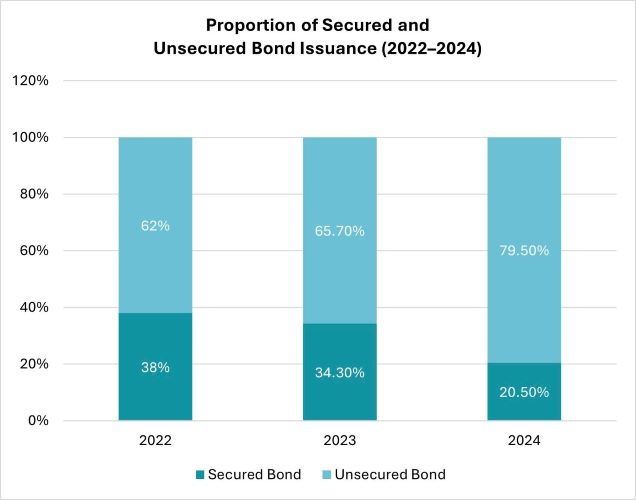

During 2022–2024, the proportion of corporate bonds with collateral dropped sharply, from 38% in 2022 to 34.3% in 2023 and only 20.5% in 2024, while unsecured bonds increasingly dominated the market. This trend reflects tighter regulations and greater transparency requirements for collateral, thereby limiting companies’ ability to use assets as issuance guarantees. At the same time, it signals a market shift toward higher transparency, creating opportunities for businesses to strengthen their credibility and improve the quality of capital raising through bonds.

Source: Vietnam Bond Market Association (VBMA), Annual Reports 2022–2024

Collateral can be real estate, machinery, production lines, shares, stocks, or other legal rights. Each type of asset has its own features, and if it is not valued correctly and objectively, the collateral may look good on paper but cannot reflect the real repayment ability when risks happen.

That is why independent valuation is critical. A valuation report is not just a number – it is also evidence of the asset’s legality, feasibility, and potential risks. For investors, it is reliable information for decision-making. For businesses, transparent valuation improves reputation and makes fundraising easier. For regulators, it is a key tool to supervise the market and reduce fraud.

In short, collateral valuation is the bridge between the funding needs of companies and the confidence of investors. Without it, the market may fall into a cycle of “artificial value,” where trust in the whole bond channel could be damaged, not just one transaction. Past events have shown clearly: without transparency, risks in the bond market can cause serious consequences. Collateral valuation is therefore more than legal compliance – it is a shield that protects investors and supports businesses to grow sustainably. When asset values are assessed fairly and objectively, the bond market can run more smoothly and become a safe, effective capital-raising channel for the economy.

CONTACT

Ha Hong Yen

Ha Hong Yen

Associate Director

📩 yen.ha@dcfvietnam.com📞 +84 965 30 44 30

Share:

References

DISCLAIMER

This content is the author’s work and does not reflect the views or positions of DCF Vietnam Corporation. Furthermore, this content is not intended to create an appraiser-client relationship, is not an appraisal/valuation, and does not substitute for a professional appraisal/valuation. Real and specific situations or assets should be considered with the advice of a professional appraiser before taking any action related to the topic discussed herein.