Real estate tokenization is becoming a global trend and has started to attract attention in Vietnam. The issuance of Law on Digital Technology Industry (2025) and Resolution 05/2025/NQ-CP (09/09/2025)—which officially pilots the digital asset market—together with the proposal to build International Financial Center (IFC) hubs in Da Nang and Ho Chi Minh City with pilot digital asset trading plans, have laid important groundwork for the development of this field.

Real estate tokenization is the process of converting the economic benefits or value of real estate into digital units (tokens) on a blockchain. These tokens can be issued, distributed, and traded transparently, allowing fractional ownership for a wide range of investors.

Overview of Real Estate Tokenization

Resolution 05/2025/NQ-CP launches a five-year pilot for digital assets, creating Vietnam’s first legal framework for tokens backed by real assets. Da Nang is proposed as an International Financial Center, piloting digital assets, crypto, and blockchain-based payments—serving as a real-world “sandbox” for real estate tokenization. Currently, there is no dedicated law for real estate tokenization. Further legislation on smart contracts, economic rights registration, and investor protection is needed to enhance transparency, reduce risk, and build market confidence.

Under Resolution 05/2025/NQ-CP, tokenization is done indirectly via licensed digital-asset issuers. Before any public offering, issuers must publish a prospectus at least 15 days in advance, disclosing the real estate valuation, including the licensed firm, methodology, and results. Tokens reflect the economic benefits of the property, not legal land ownership.

Market Outlook

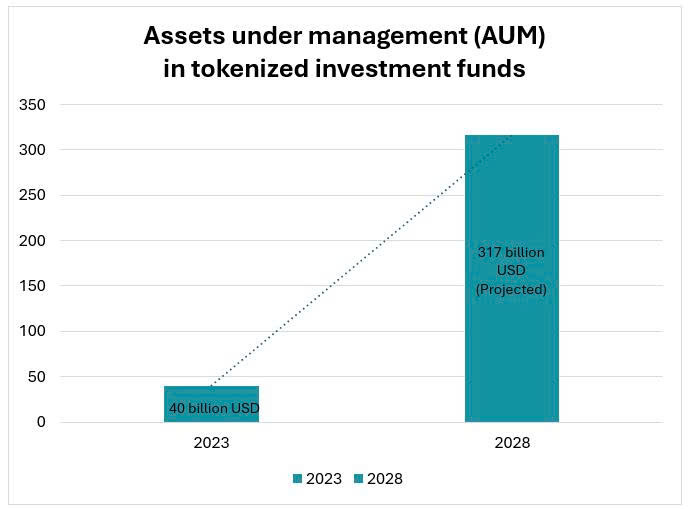

PwC projects that the global market for tokenized investment funds will grow from around USD 40 billion in 2023 to more than USD 317 billion in 2028, representing a compound annual growth rate (CAGR) of over 50% during 2023–2028.

Deloitte’s report Digital dividends: How tokenized real estate could revolutionize asset management further predicts that the global market for commercial real estate tokenization will expand dramatically by 2035, highlighting the accelerating trend toward asset digitalization

Source: Asset & Wealth Management Report (PwC, 2024)

AUTHORS

Ha Hong Yen – Associate Director

&

Huynh Le My Tien

CONTACT

DCF VIETNAM CORPORATION

📍 46F Bitexco Tower, 2 Hai Trieu, Sai Gon Ward, Ho Chi Minh City, Vietnam

📩 yen.ha@dcfvietnam.com

📞 +84 965 30 44 30

Around the world, many successful models have emerged

These examples demonstrate that successful real estate tokenization is typically executed through licensed issuers, with tokens representing only the economic rights linked to the underlying property

Germany: Projects like the €250 million Fundament Real Estate Token, approved by BaFin as a digital bond backed by a portfolio of properties, and the Bloxxter initiative in Leipzig show practical commercial and residential real estate tokenization.

Singapore: Any digital/security token that qualifies as a capital markets product must be issued and traded through a licensed entity (CMS/RMO), with strict KYC/AML and disclosure requirements.

Switzerland: Blockimmo has tokenized commercial properties in Zurich under the supervision of FINMA, allowing investors to own fractional interests in real assets with regulatory protection.

Common Implementation Structure: Special Purpose Vehicle (SPV)

A widely used global model employs a Special Purpose Vehicle (SPV)—a legal entity created specifically to own, manage, and issue tokens for a particular property project:

- The property owner or developer transfers the financial rights of the asset (sale revenue or rental income) to the SPV.

- The SPV issues tokens representing the project’s economic interests.

- Investors purchase tokens from the SPV and indirectly receive cash flows from the property, similar to dividends or bond coupons.

Unlike traditional securitization, tokenization allows fractional interests and direct trading on digital platforms, bypassing some intermediaries and enhancing liquidity. However, it also requires a clear regulatory framework to protect investors, especially if the SPV or project encounters risk.

Real estate tokenization opens a new era of asset management and distribution, delivering greater transparency, liquidity, and access to capital Resolution 05/2025/NQ-CP marks Vietnam’s first crucial step, but a comprehensive legal framework is essential for sustainable growth. With the combination of this pilot policy, rising market demand, and blockchain technology, real estate tokenization could become a key investment channel and strengthen Vietnam’s digital economy.

References:

Disclaimer

This content is the author’s work and does not reflect the views or positions of DCF Vietnam Corporation. Furthermore, this content is not intended to create an appraiser-client relationship, is not an appraisal/valuation, and does not substitute for a professional appraisal/valuation. Real and specific situations or assets should be considered with the advice of a professional appraiser before taking any action related to the topic discussed herein.